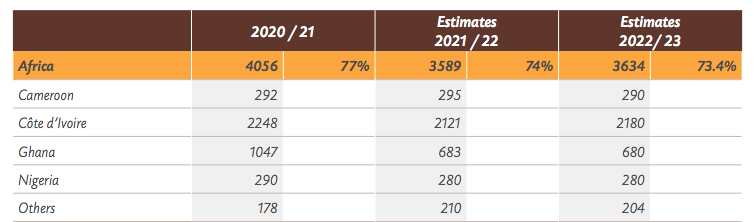

Cocoa production in Ghana has been falling off the cliff since posting a record 1.047 million metric tonnes (MT) at the close of the 2020/21 season.

The country, currently the world’s second-largest cocoa producer, has seen its crop output decline to 667,500 MT in 2023, with projections for the prevailing 2023/24 crop around 500,000 metric tonnes. But this nightmarish trend is not peculiar to Ghana.

Ivory Coast, the world’s leading producer of cocoa beans, also finds itself battered by rough winds. From a 2.25 million MT crop output in 2020/21, it closed the last crop year at 2.18 million MT, with an even worse outlook for the current season.

The palpable result is galloping prices sparked by a global supply deficit projected for a third straight season this year. Ivory Coast alone is said to record a shortfall of close to 600,000 MT for the 2023/24 crop.

“We are in a very tight balance,” said Paul Davis, the president of the European Cocoa Association, according to Bloomberg from the Amsterdam Cocoa Week this month. He fears the situation will likely last for another 18 months to three years.

Source: Global cocoa supply / ICCO

Davis warned, “There is no cavalry that’s coming to the rescue… Consumers will need to understand that it will cost a bit more in the near term, but in the long term, it will be good for the environment,” Davis said.

A multiplicity of factors account for the downward trend in production, with a prolonged El Niño phenomenon and climate change-induced extreme weather patterns impacting most producers.

However, the situation in Ghana is further exacerbated by the destruction of cocoa plantations by illegal small-scale mining activities and the Cocoa Swollen Shoot Virus Disease (CSSVD).

CSSVD Devastation

Source: CSSVD-infected cocoa tree

Ghana has been in this painful and long-drawn-out battle against this pestilent cocoa disease for decades. Official data indicate that “CSSVD accounts for about 17% loss in cocoa production annually,” according to Dr Kwame Owusu-Ansah, the national coordinator of the country’s cocoa rehabilitation effort initiated by COCOBOD.

The “area of CSSVD infestation currently stands at 592,230.02 hectares, according to data from our third country-wide survey [in 2023].”

This represents an average 88% increase in disease coverage in 6 years, compared to the 315,000 hectares initially recorded at the first survey in 2017.

With this alarming rate of spread, there are concerns that if concerted multi-stakeholder action is not taken, the disease could sweep across Ghana’s 1.9 million hectares of cocoa farms.

Physiology of CSSVD

The Cocoa Swollen Shoot Virus Disease (CSSVD) was first detected in the mid-1930s, according to the Cocoa Research Institute of Ghana (CRIG).

Plant pathologists say the Cocoa Swollen Shoot Virus (CSSV) is transmitted by insect vectors known as mealybugs, but they may not rule out deliberate and non-deliberate human activities in its spread, even from one region or country to another.

Once a tree is infected, the virus begins to make millions of copies of itself and spread to new tissues of the cocoa tree, eventually sapping life out of every cell of the cocoa tree.

Scientists explain that the symptoms of this strain on the cocoa tree manifest as reddening of the leaf tissues (red vein banding, RVB), the depletion of plant chlorophyll (leaf chlorosis), leaf deformations, and then swellings of shoots and roots.

Thus, the Cocoa Swollen Shoot Virus Disease is named after this characteristic stem or shoot swellings that are often seen in some affected plants.

Disease Destroy Farmers’ Livelihoods

Peter Kwabena Nartey, 68, is a cocoa farmer from the Suaman-Dadieso District in Ghana’s Western North Region.

He is one of thousands of cocoa farmers living with the harrowing experience of losing their livelihoods to the devastating effects of CSSVD.

“I observed swellings on some cocoa trees on my farm, but I had no clue what it was,” Nartey said.

Nartey reported the strange development to agric extension officers. He recalled, “They inspected it, and it turned out to be the deadly disease,” known in local parlance as ‘kokoo sasabrɔ’ (cocoa rheumatism).

He was advised to immediately remove all cocoa trees from his 3.2-hectare farm to curb its spread.

Kwabena Nartey lost his 3.2-hectare cocoa farm to CSSVD (Photo: Cocoa Post)

But since he does not have the wherewithal, he decided to let nature take its course, despite the risk of fanning a spread to adjoining cocoa farms.

Trapped in this difficult situation, scores of Ghana’s cocoa farmers have turned to other cash crops, like oil palm, rubber, and coconut, or traded in their farmlands to illegal gold miners, who are reported to offer attractive cash packages.

Cocoa Buyers’ Business in Limbo?

Research indicates that within one year of infection, a cocoa’s farm productivity may drop by 25% and fall further to about 50% the second year.

“In very severe cases, cocoa trees succumb to the virus and die within 3 years of infection,” in which case “there is a 100% yield loss,” according to the Cocoa Research Institute of Ghana (CRIG).

Industry players say the correlation between the raging Cocoa Swollen Shoot Virus Disease and the sharp decline in production cannot be swept under the rug.

In Ghana, licenced cocoa buying companies (LBCs) aggregate cocoa produce from upcountry to Cocobod takeover centres for a commission.

“The core of the business of LBCs is to buy cocoa and buy as much as possible. If the cocoa is not there, then you’re out of business,” said Victus Dzah, General Secretary of Ghana’s Licenced Cocoa Buyers Association (LICOBAG).

“The impact of CSSVD has reduced the tonnage. Ghana produced 1 million tonnes in 2020/21. [In] 2021/22 too, we could have gotten that, but because of this disease, we couldn’t, so it is affecting our business.”

According to CRIG, Africa’s foremost cocoa research centre, “There are no curative treatments for CSSVD yet.”

Its scientists recommend the “cutting-out” practice as a form of destructive treatment. They also, as a form of precaution, advise cutting out all cocoa trees that are in physical contact with the felled CSSVD trees.

By this method, all cocoa trees on infected farms are removed, and the farm is treated and replanted with new disease-resistant hybrid seedlings. Globally, CSSVD is estimated to have destroyed over 300 million cocoa trees.

Proven Intervention

Ghana is not new to implementing this scientific recommendation, known in industry parlance as cocoa rehabilitation.

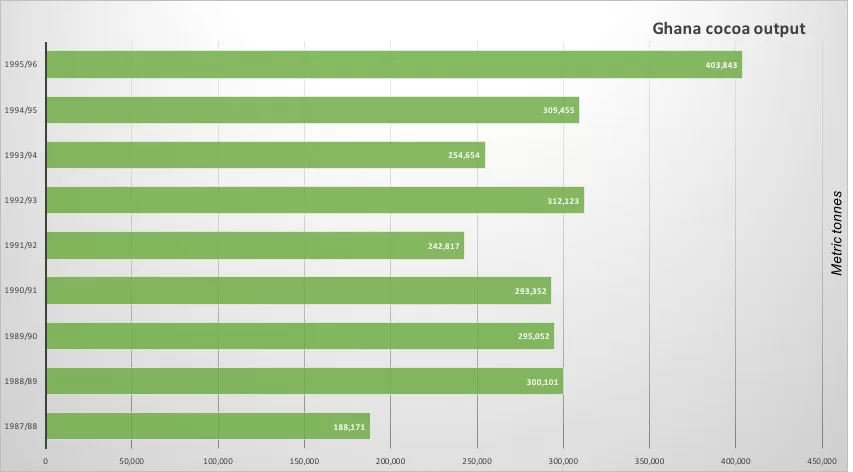

Between 1989 and 1993, the West African country procured a $127 million AfDB-led loan to tackle a CSSVD outbreak with a coverage of about 17,900 hectares.

The 5-year Cocoa Rehabilitation Project was implemented as part of a broad cocoa sector reform to boost productivity and increase production output by eliminating bottlenecks like the CSSVD.

That effort paid off, and the disease was effectively controlled by cutting out 16,537 hectares of diseased farms and replanting some 3,810 hectares of hybrid cocoa.

A 2002 Africa Development Bank project performance evaluation report linked the cocoa rehabilitation project to an annual incremental production of 110,000–115,000 metric tonnes.

This is corroborated by data obtained from the Ghana Cocoa Board, which indicates that the country’s output spiked from a low of 188,171 metric tonnes in the 1987/88 crop season to 403,843 metric tonnes by the close of the 1995/96 season, representing a 114.6% increase in less than 10 years.

Source: Ghana Cocoa Board / Cocoa Post

Ghana’s New CSSVD Wave

In 2017, following concerns over stagnation in Ghana’s production, the sector regulator, COCOBOD, commissioned a nationwide survey of all cocoa farms.

Among others, the report revealed an unprecedented scale of CSSVD infestation across the cocoa belt, which comprises seven cocoa-growing regions.

“We had 315,000 hectares of cocoa farms that had been affected by the Cocoa Swollen Shoot Virus Disease,” Joseph Boahen Aidoo, Chief Executive of Ghana Cocoa Board, told Cocoa Post in a 2022 interview.

“Apart from that, we also had over 400,000 hectares of cocoa farms that could be described as moribund, in other words, overaged and therefore not fruiting.”

In a bid to tackle the HIV-like disease, the government of Ghana secured a loan from the African Development Bank (AfDB) in 2020 to scale its successful cocoa rehabilitation pilot project carried out two years prior.

Out of the $600-million AfDB credit facility, some $230 million was voted to rehabilitate 156,400 hectares of CSSVD-infected cocoa farms across the country.

The intervention, dubbed the National Cocoa Rehabilitation Programme (NCRP), involved paying out a compensation package of GHS1,000 per hectare apiece to both the cocoa farmer and land owner (where applicable) to hand in diseased farms to Cocobod for rehabilitation at no cost to them.

The rehabilitated farm is maintained by Cocobod for 2 years after which it is handed over to the farmer.

Nature-Based Solutions

Encumbered by labour challenges and a rather slow pace of programme implementation, Ghana Cocoa Board in 2022 partnered with a private Ghanaian farm management and agri-forest landscape restoration services company to accelerate progress.

With a field personnel or labour strength of more than 30,000 spread across all cocoa rehabilitation operational regions, Afarinick Company Limited is leveraging its peerless capacity to help breathe fresh life into cocoa production in Ghana.

Rehabilitated cocoa farm in the Western North Region replete with plantain as shade crop

It boasts a 50-million-capacity industrial seedling production facility and has experience in farm maintenance and extension services, sustainability consulting, and logistics services.

“We believe the cocoa rehabilitation programme is a blessing of sorts in that it allows Ghana to not only rejuvenate cocoa plantations but also implement cocoa agroforestry systems for biodiversity conservation, carbon sequestration, and supply chain resilience,” said Ms Effe Heathcote, Projects & Sustainability Manager of Afarinick Company Limited.

She noted that while providing jobs for the youth, the firm also operates a policy that prioritises employment for CSSVD-affected cocoa farmers as a way of empowering them with alternative income until their cocoa farms can produce again.

The leading Ghanaian farm service company says its deployment of modern farm machinery like motorised slashers for farm maintenance and earth augers for drilling planting holes means it’s able to deliver with speed.

According to officials, Afarinick’s formalised system of engaging farm labour ensures strict adherence to legal, regulatory, and industry labour and human rights requirements, answering one of the cocoa sector’s biggest challenges.

We are poised to forge key partnerships to catalyse investments for nature-based solutions.

In compliance with regulatory requirements like the EU Deforestation Regulation, Afarinick has invested in the application of geographic information systems (GIS) and drone technology for mapping, field monitoring, and real-time reporting of activities.

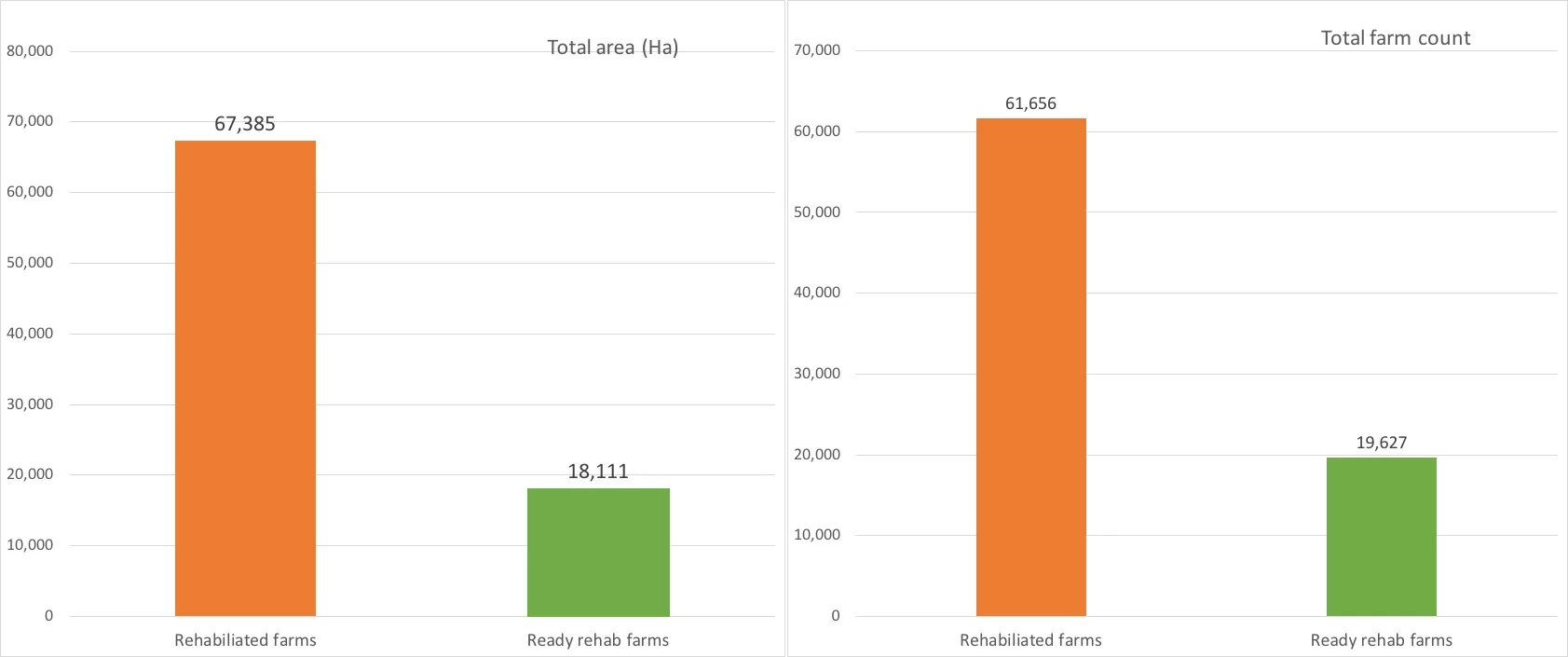

“By implementing the three main activities of treatment, farm establishment, and farm maintenance, we are proud to have so far successfully rehabilitated over 61,000 hectares of diseased cocoa farms,” said Ben Asare, General Manager of Afarinick, adding that “we are poised to forge key partnerships to catalyse investments for nature-based solutions.”

Partnership to Save Cocoa

Source: CHED, Ghana Cocoa Board / Cocoa Post

“So far, a total of 61,656 farms covering an area of 67,385.43 hectares have been successfully rehabilitated.

Out of this, a total of 19,627 farms covering an area of 18,110.94 hectares have been certified ready to be handed over to their respective beneficiaries,” said Dr Owusu-Ansah, Coordinator of the National Cocoa Rehabilitation Programme.

With the outstanding area to be rehabilitated currently standing at 524,844.59 HA, or 87.8% of the CSSVD infection coverage nationwide, stakeholders believe more would have to be done for the rate of rehab to catch up with the spread.

Although this is not the first CSSVD outbreak Ghana has had to contend with, the current wave surely appears quite unforgiving.

But despite the impact of the disease being felt in consuming countries, Ghana’s battle with the ravaging disease seems to have hardly made it an agenda item in company boardrooms in Europe, Japan, or North America.

“With the exception of funding support from AfDB and the World Bank, who is also coming on board, there are no supports of such sorts from COCOBOD partners currently,” Dr Owusu-Ansah said.

So far, Ghana has been single-handedly holding up against the disease. But its feeble war chest is no match for the average 14.6%, or 45,905 HA per year, rate of new CSSVD infections.

The battle against CSSVD is a global concern and must be tackled holistically by all stakeholders in the cocoa value chain.

While cocoa farmers continue to suffer loss and damage to their livelihoods on the frontlines, the aftereffects can also be seen contributing to record cocoa prices, which hit a new all-time high of $5,874 (£4,655) a tonne on Thursday, February 8, 2024, on the New York commodities market.

For COCOBOD’s cocoa rehab czar, “The battle against CSSVD is a global concern and must be tackled holistically by all stakeholders in the cocoa value chain.”

Samuel Adimado, the president of Ghana’s cocoa buyers’ association, agrees. He wants more awareness creation on the adverse impact of CSSVD on the industry, namely yield reduction, livelihood erosion, and lack of return on investment.

“Once it is amplified, I believe all stakeholders in the industry will come on board.”

Drying Cocoa Reserves

The global chocolate business is worth some $130 billion annually, but only 6% of the value goes upstream to producers and their growers, most of whom earn less than $1 a day.

Experts are convinced that Ghana’s rehabilitation initiative presents an opportunity for companies to plough back a portion of their profits as investment in the programme to sustain the production of their core raw material, cocoa beans.

It is therefore a question of “the willingness to deploy some into the upstream to sustain the crop, and for that matter, sustain their business, becomes a foot-dragging issue,” he contended.

Cocoa production experts are projecting disastrous consequences should industry continue to sit on the fence “Because we will be there and the market will dry up, and that will be the end of it.”

The production decline challenge in Ghana and Cote d’Ivoire has so far wiped more than 300,000 metric tonnes from the global supply of cocoa beans in the last three years alone.

Apart from Ghana’s efforts, Cote d’Ivoire, the world’s top cocoa producer, lacks an active response to CSSVD, posing a significant concern going forward as companies deplete their reserves.

- Illegal Mining Threatening Ghana’s $230M Cocoa Rehabilitation - April 10, 2024

- Ghana Raises Cocoa Farmgate Price by 58.26% to GHC2,070 per bag - April 5, 2024

- New Standard for Measuring Cocoa Household Income Launched - April 5, 2024