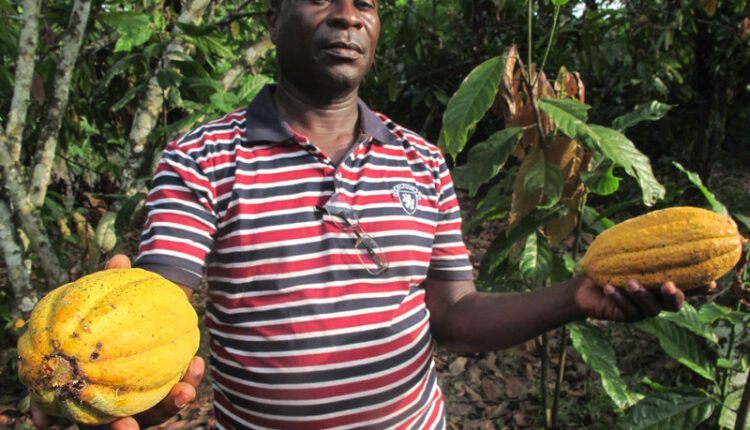

Does Ghana’s Cocoa Policies Resolve The Low Income Of Its Farmers?

Cocoa is of critical importance to the Ghanaian economy, hence the effects of low income with farmers isn’t just seen as a threat to their livelihoods but also a threat to the economy.

So, the objective of protecting the economy and the incomes of farmers has led to the Ghana government’s implementation of several policy interventions. Two of the cocoa policies that this article will be focusing on assessing its impact on the income constraints of cocoa farmers are Cocoa Stabilisation Fund policy (CSF) and the Free Fertilizer distribution Policy.

Cocoa Stabilisation Fund (CSF) and Its Issues

CSF is a fund that is used to accumulate surpluses from the cocoa trade to stabilise the producer prices for cocoa farmers during periods of cocoa price drops on the world market.

This has meant that to build up the fund, farmers were paid producer prices that were considerably lower than the world market prices.

The idea of price stabilisation was said to be the objective of the establishment of the Cocoa marketing board at the beginning of the World War 2 to protect the commodity from the price effects of the shrinking markets due to the war.

However, after Ghana gained independence, the surplus that had been built in the fund were used allegedly by the Nkrumah government to implement its import substitution industrialisation, hence depleting the fund. Even though in principle the fund was in a position to protect farmers’ income, its use in practice demotivated farmers hence contributing significantly to the drop of Ghana’s global production share of 38% to 10%.

However, to regain farmers’ commitment to reviving the sector, the government resisted the reforms recommended by the Washington consensus, maintained its control over the sector and implemented its economic recovery program where they increased the share of export prices going to farmers, implemented the cocoa plantations, provided consistent extension services etc to farmers.

This indicated an increase in farmers income from the sector and incentives to produce more. Ghana grew to be the second-largest producer of the commodity and its consistent provision of quality cocoa beans earning them a premium price in the world market.

However, the huge drop in the world market price for the commodity in recent times according to Ghana’s finance minister, Ken Ofori Atta, in 2018, induced their decision to not increase Producer prices as traditionally known, from 2016/17 to 2018/19 crop season.

He also advised the government to stop stabilizing cocoa price and allow farmers to be exposed to the fluctuations in the cocoa market, which technically suggest the dissolution of the CSF. This advice if implemented poses a significant risk to farmers reception of consistent income from the sector.

However, Ghana and Ivory Coast have agreed to implement a floor price of 2,600 per ton. This floor price can play the role of CSF as it assures farmers of a guaranteed income even when they are exposed to the market volatility as advised by the minister.

But in the long-term will farmers’ dependence on price increases be sufficient at providing them with the income required to solve their challenges? This will be explored in a later article.

Free Fertilizer Policy and Its Move To Subsidization Of Fertilizer Policy

Another policy intervention was the government’s enactment of the free fertilizer policy as a commitment to reducing farmers cost of production and subsequently enhance their income by enhancing their yields. However, Government officials responsible for the distribution of this free fertilizers started smuggling these fertilizers into other non-cocoa markers for sale.

Farmers who were able to receive these fertilizers also received it at the wrong time, hence its application not achieving the desired output.

This brought back the question of how the situation would have been if farmers had enough income to buy their fertilizers. The assumption is that they would have been able to buy them at the right time without feeling the negative effects of smuggling the current policy exposes them to. This is what led to the replacement of this policy with the subsidization of fertilizer in 2017.

Unfortunately, this subsidy comes in at a point where the producer price for cocoa in Ghana has remained the same since 2016/17 till 2019/20 crop years while the country’s inflation rate is also at an annual average of 9.1%.

This leads to a constant reduction in the real monetary value of the producer price farmers receive due to inflation and an increase in the cost of production because they now have to purchase fertilizers.

In a nutshell, these two policies had good intentions and a positive outlook but its effects on improving the longstanding income constraints on the livelihoods of smallholder cocoa farmers are still yet to be significantly experienced.

However, Ghana and Ivory Coast’s ability to have fixed the cocoa floor price at $2,600 per ton is a step in the right direction. However, as to whether cocoa farmers in Ghana, whose producer prices are determined by the government will experience any change in their prices, we wait to see.

[wp_quiz id=”3997″]

- Are Cocoa Farmers Paid The Whole US$ 400/MT LID Levy? - February 10, 2022

- Is A Potential ‘COPEC’ Up To The Task Of Protecting Cocoa Farmers? - October 10, 2021

- The Cocoa Sector & Europe’s Renewed Lab-Grown Chocolate Agenda - August 26, 2021