Ghana And Côte d’Ivoire Taste Success In Raising Price Of Cocoa

Through a joint initiative, Ghana and Côte d’Ivoire have managed to convince chocolate traders and makers to raise the price they pay for cocoa.

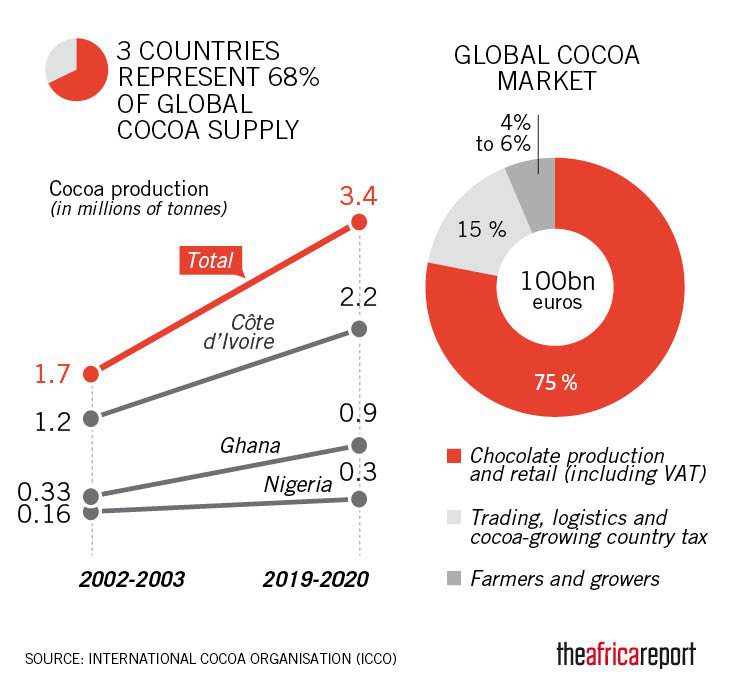

With Côte d’Ivoire and Ghana, the world’s top two cocoa producers, as well as Nigeria, which ranks fifth behind Ecuador and Cameroon, ECOWAS member countries account for 68% of global cocoa supply.

In other words, 3.4 million tonnes were harvested in the 2019-2020 season, out of a worldwide total of 5 million tonnes.

The problem is that Africa’s cocoa producing countries capture just 3% of global chocolate industry revenue, according to figures from the International Cocoa Organization (ICCO).

Although Côte d’Ivoire produced 2.1 million tonnes of cocoa in 2017 (44% of global output), it brought in just $3.3bn (€2.9bn) from the trade, compared to earnings of $22bn[HE1] for US chocolate majors.

While these three West African nations have substantially increased their cocoa production over the past 20 years, it wasn’t until 26 March 2018 that cocoa farmers and trade federations from Côte d’Ivoire and Ghana formed their first strategic partnership agreement.

A first success

On that date, Ivorian President Alassane Ouattara and his Ghanaian counterpart Nana Akufo-Addo signed the Abidjan Declaration, thereby creating “an OPEC for cocoa”.

Through this partnership, Côte d’Ivoire and Ghana – which together produce 65% of the world’s cocoa – will harmonise their sales policies to have greater impact and increase their earnings.

Back in July 2019, Côte d’Ivoire’s Coffee and Cocoa Board (CCC) and the Ghana Cocoa Board (COCOBOD) successfully imposed a pricing mechanism to help producers earn a living wage.

Their suspension of forward sales of cocoa beans had such a negative impact on global prices that, in less than a month, chocolate traders and makers agreed to the idea of a $400 a tonne premium on all cocoa sales contracts.

Known as the “living income differential” (LID), this premium will take effect in the 2020-2021 season, which begins in October, and will help ensure better pay to producers.

Much room for improvement

The partnership between CCC and COCOBOD is also based on coordinating production seasons, as it includes an agreement on market volumes and sets a standard price for producers to prevent smuggling along the border.

What’s more, both partners have plans to build storehouses in which harvests can be stockpiled until their sale on the market at a later date. In keeping with this idea, Côte d’Ivoire will “cap” its cocoa production at 2 million tonnes.

Full article here

- Côte d’Ivoire and Ghana: Bitter About ‘Conspiracy to Undermine Farmers’ By Cocoa Traders - December 5, 2020

- Ghana And Côte d’Ivoire Taste Success In Raising Price Of Cocoa - September 10, 2020